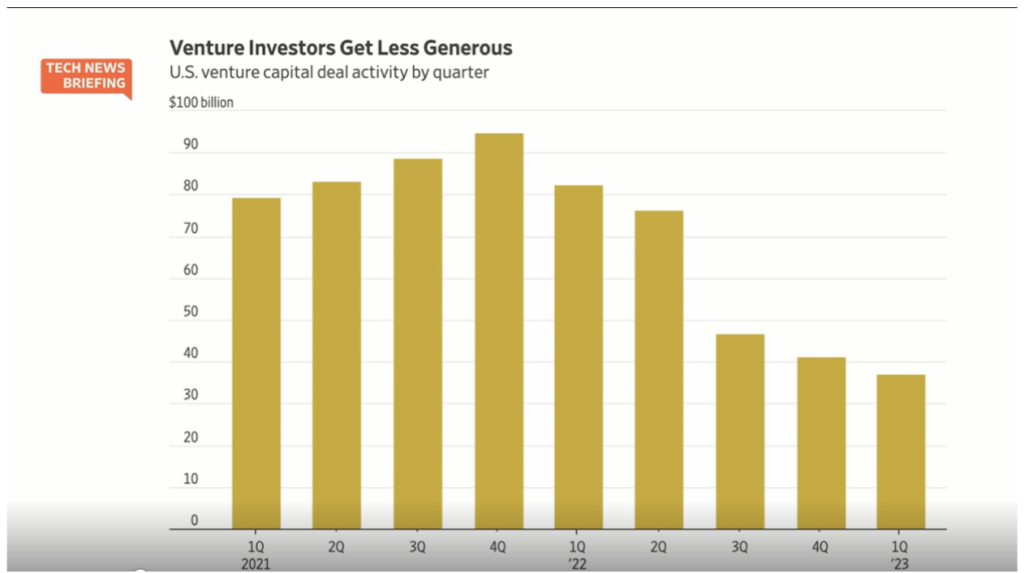

Love them or hate them, VCs will have a smaller footprint in the startup world moving forward. The metrics speak for themselves. Axios reports that the total value of M&A deals fell by 38% and volume declined by 18%; in the U.S., deal value fell by 39% and volume fell by 15%. There’s been a steady slowdown in startup funding.

Kinder voices than mine will blame it on external sources. The pandemic, layoffs, the war, our jittery relationship with China and other moments in time. I think it goes deeper to a flawed system. And while I hate to use the Silicon Valley Bro caricature, there’s a ring of truth to the “in-crowd” mentality, and focus on short term gains that pervades the VC community. White bros who dress the same, talk the same, and move with same insouciance are getting long in the tooth. Smart money and new ways of thinking are going to find a workaround.

My favorite VC video, though a little long in the tooth, is this one, where Nicolas Tesla pitches a group of VCs. Bored, distracted and oh-so white, they can’t decide which of their buckets to put his product in, or even whether they want to see his deck. Marching out of lock-step is not only not done, the lockstep has been shown to have hazardous repercussions.

A few recent examples? Take Bobby Lee’s death at the doorstep of his San Francisco condominium. Bay Area VCs were quick to blame the death on San Francisco’s lawlessness, lamenting that the city had become an impossible place to do business. While any death is a tragedy, Lee’s was ultimately found to be caused by ketamine, cocaine and a jealous relative in a sordid affair. But the damage was done. VC bros became judges and executioners, and their words had consequences.

Or take the case of Peter Thiel, the Silicon Valley entrepreneur, who tweeted to his bros that they should be “getting their money out of Silicon Valley Bank.” He nearly single handedly started a run on the bank. It was something out of a moment from the Bailey Savings and Loan (It’s a Wonderful Life), only this time there was no Jimmy Stewart to let good sense prevail.

What about the letter penned by leading VCs calling for a moratorium on ChatGPT and its ilk? A letter signed by 1000 VC types including Elon Musk and Steve Wozniak asked for a halt to any further developments on Generative AI until it could be assessed further. Now, most of those very same signatories are pouring money into anything with the letters “A” and “I” in it.

Lemmings are not good for innovation. And they’re not good for building new, more inclusive companies. Only about 1.87% of $31 billion held by 200 venture capital funds has been allocated to startups with diverse leaders, according to a report from the nonprofit Diversity VC. A look at the VC landscape for 2023 by Deloitte found that while the VC industry has made some progress in hiring women, the numbers of black and hispanic hires are still quite dismal. Why does that matter? Because a diverse group of VCs is more likely to represent a diverse group of entrepreneurs.

Forging their Own Paths

There are enough books like Brotopia by Emily Chang that expose the sexism, racism and general bad behavior of the Bro-boys, but it’s more instructive to look beyond them (especially if you believe they’ll grow more irrelevant. )

There’s going to be more of a grassroots “lets fund our own” movement from women, blacks and hispanics and that’s a good thing. It’s painful and a waste of time for founders to grovel where they’re not wanted.

Take Coralus (formerly SheEO) as an example, The model is more like a Tupperware Party meets investment club. Members kick in $1,000 to be in the club. Women and minorities turn in their product realities. No idea or ask is too small and many of the applicants have very little to show in the way of profit yet. The group upvotes the best ideas. They get funded with a no interest loans, but also get the benefits of a community of mentors/cheerleaders and shoulders to cry on, as they take their dreams through the start up process.

Coralus CEO Vicki Saunders calls it a community-centered, blended finance model and believes it’s a transformative way to give more people an opportunity to have skin in the game. She reports $16.5 million dollars in capital currently in circulation and a near-perfect return on the loans. Mary Ann Pierce, co-founder of Awaken Hub uses a similar philosophy, elevating women entrepreneurs, only this time in Northern Ireland. Fearless Funds supports women of color who are founders (a group that currently only secures .27% of VC funds). Harlem Capital invests in black startups and entrepreneurs. And the LatinX community has its own variety of venture funds.

It’s sad that we’ve had to create specialized funds based on gender, ethnicity, and color. The mainstream VC community has built a crazy culture with the deck stacked against anyone who isn’t part of the inner circle. The reality is that they’ve done little to differentiate themselves or their services. The mostly white, mostly male dominated VC community had its chance to widen the tent but has been too slow on the draw. As we enter the next chapter of more intentional, DEI focused investment, we can only hope that they don’t model themselves in the image of what was, but what could be.

Founders can decide for themselves what sort of investor they want, but if access to hard-to-come-by technology that can get them a step ahead of their competitors lies in the balance, I think we know what choice they’ll make.